Odoo 19 marks a significant leap forward in accounting automation, introducing a suite of powerful features designed to streamline invoicing processes, enhance compliance, and empower businesses with greater financial control. This article, the first in a four-part series, delves into the transformative capabilities of Odoo 19’s automated e-invoicing and self-billing management systems. These innovations are set to redefine how organisations handle their financial transactions, offering unprecedented efficiency and accuracy.

Automated E-Invoicing: A New Era of Efficiency

Odoo 19’s enhanced e-invoicing capabilities are at the forefront of its accounting revolution. With compliance extended to 58 countries, Odoo provides a truly global solution for businesses operating across diverse regulatory landscapes. The introduction of automated Peppol setup simplifies the onboarding process, allowing companies to connect to the Peppol network with minimal effort. This enables seamless and standardised electronic document exchange with other Peppol-connected businesses and government agencies.

The system's intelligence is further demonstrated through its AI-powered “Auto-sort” feature, which automatically files incoming documents, reducing manual data entry and minimising the risk of human error. This, combined with support for various e-invoicing formats such as e-Fatura, e-Arşiv, and NFC-e, ensures that businesses can adapt to a wide range of customer and supplier requirements.

Self-Billing Management: Empowering Supplier Collaboration

Another groundbreaking feature in Odoo 19 is the introduction of Self-Billing Management. This allows a customer to create the invoice on behalf of their supplier and send it to them for verification. This process, also known as evalu-ated receipt settlement (ERS), streamlines the procurement-to-pay cycle, reduces administrative overhead, and strengthens supplier relationships.

The configuration of self-billing is straightforward, as shown in the screenshot above. By enabling the “Self Billing” option in the purchase journal, businesses can automate the creation of invoices based on received goods or services. This eliminates the need for suppliers to generate and send invoices, leading to faster payment cycles and improved cash flow for both parties.

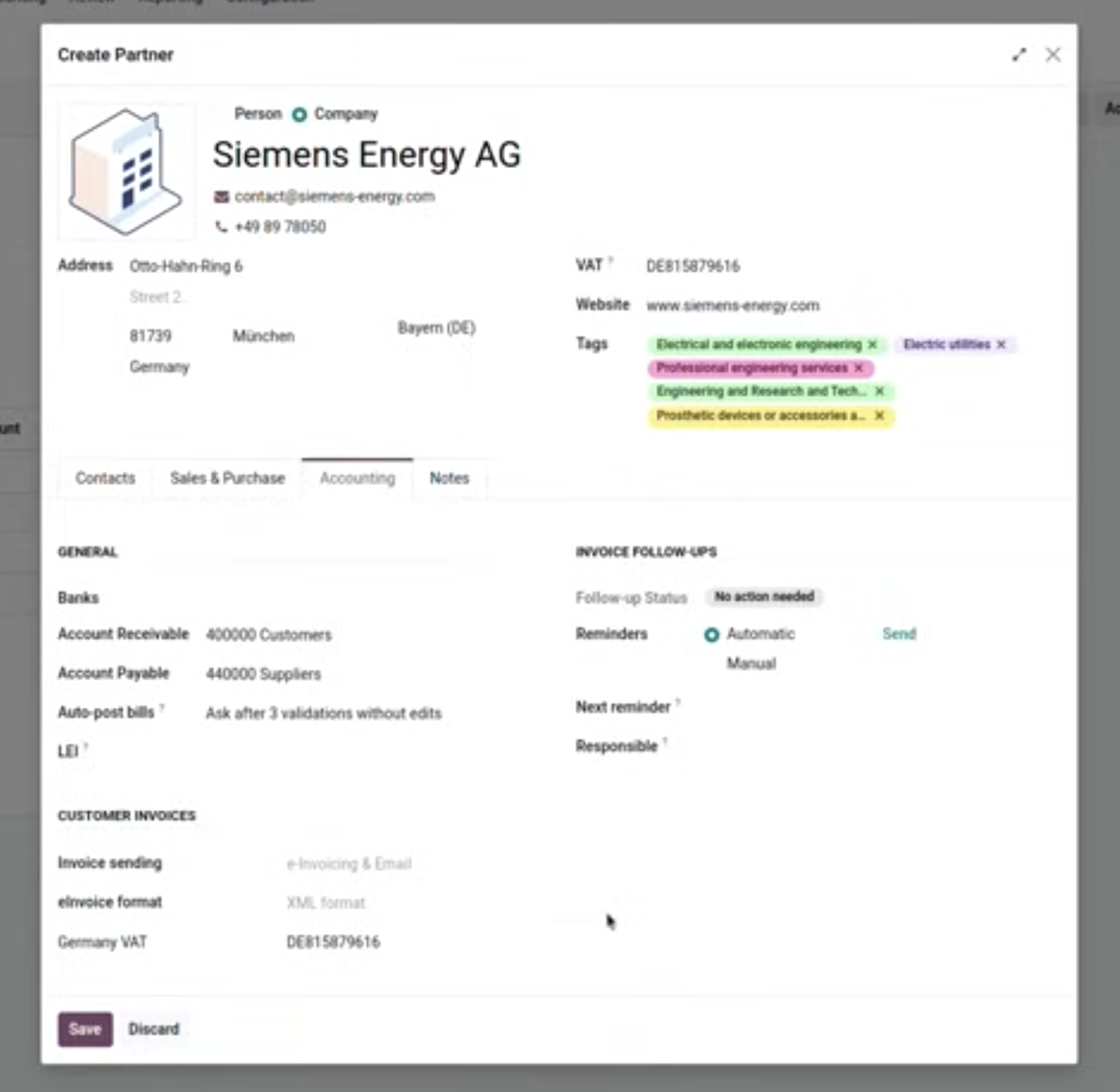

Enhanced Partner Management and Invoice Follow-ups

Odoo 19 also enhances partner management with more granular control over invoicing processes. The “Create Partner” screen now includes options for configuring automated invoice follow-ups, ensuring timely payment reminders are sent without manual intervention. This proactive approach to accounts receivable management helps to reduce late payments and improve overall financial health.

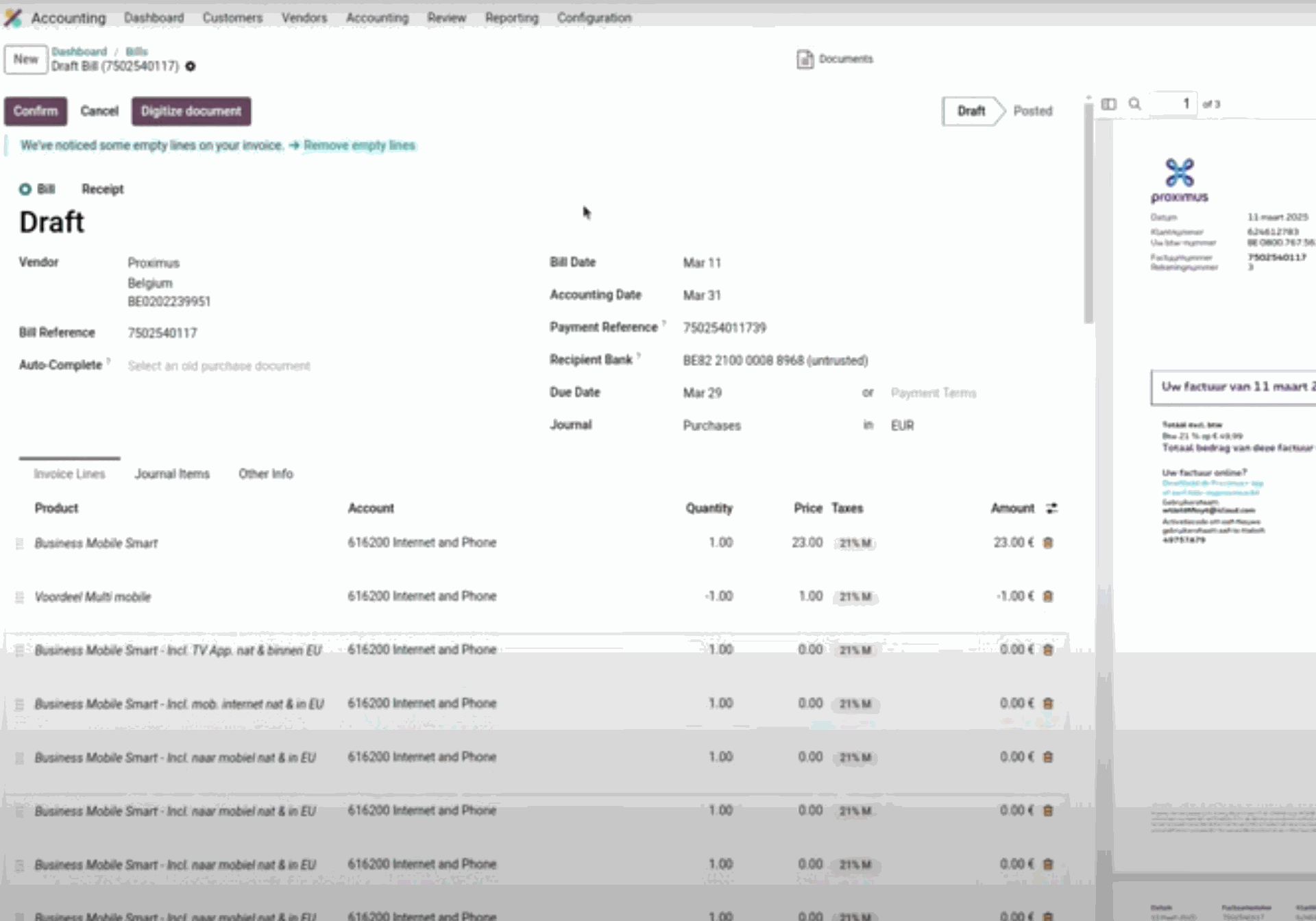

The system's ability to digitise bills using Optical Character Recognition (OCR) technology further streamlines the accounts payable process. As seen in the screenshot below, Odoo can extract relevant information from a scanned or PDF invoice, such as the vendor, bill reference, and line items, and automatically populate the corresponding fields in the system. This significantly reduces the time and effort required to process incoming invoices.

Conclusion

Odoo 19’s automated e-invoicing and self-billing capabilities represent a paradigm shift in accounting technology. By automating key processes, enhancing compliance, and improving collaboration, Odoo empowers businesses to achieve greater efficiency, accuracy, and financial control. The next article in this series will explore the advancements in bank reconciliation and payment processing, further highlighting Odoo 19's commitment to delivering a comprehensive and intelligent accounting solution.

Odoo 19: Revolutionising Accounting with Automated E-Invoicing and Self-Billing